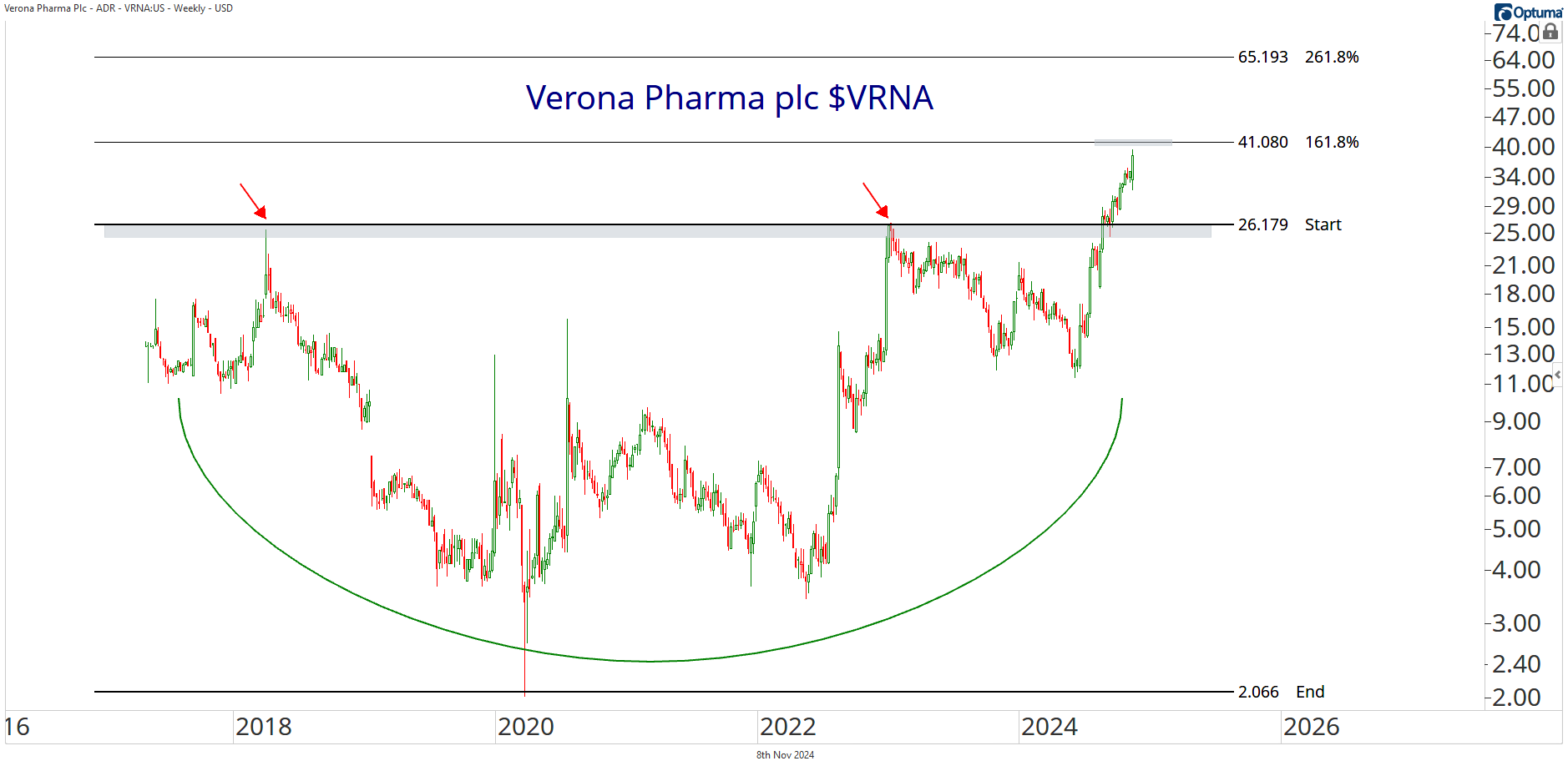

While some consolidation would be healthy to digest recent gains, biotechs are on a roll and we are betting that VRNA's upward path will continue.

We’re targeting 65 over the coming 2-4 months.

Have a great weekend. We'll be back on Monday with more insider activity.

And please reach out with any questions. We love hearing from you!

For questions about your membership, contact us at 323-421-7910 or info@stockmarketmedia.com