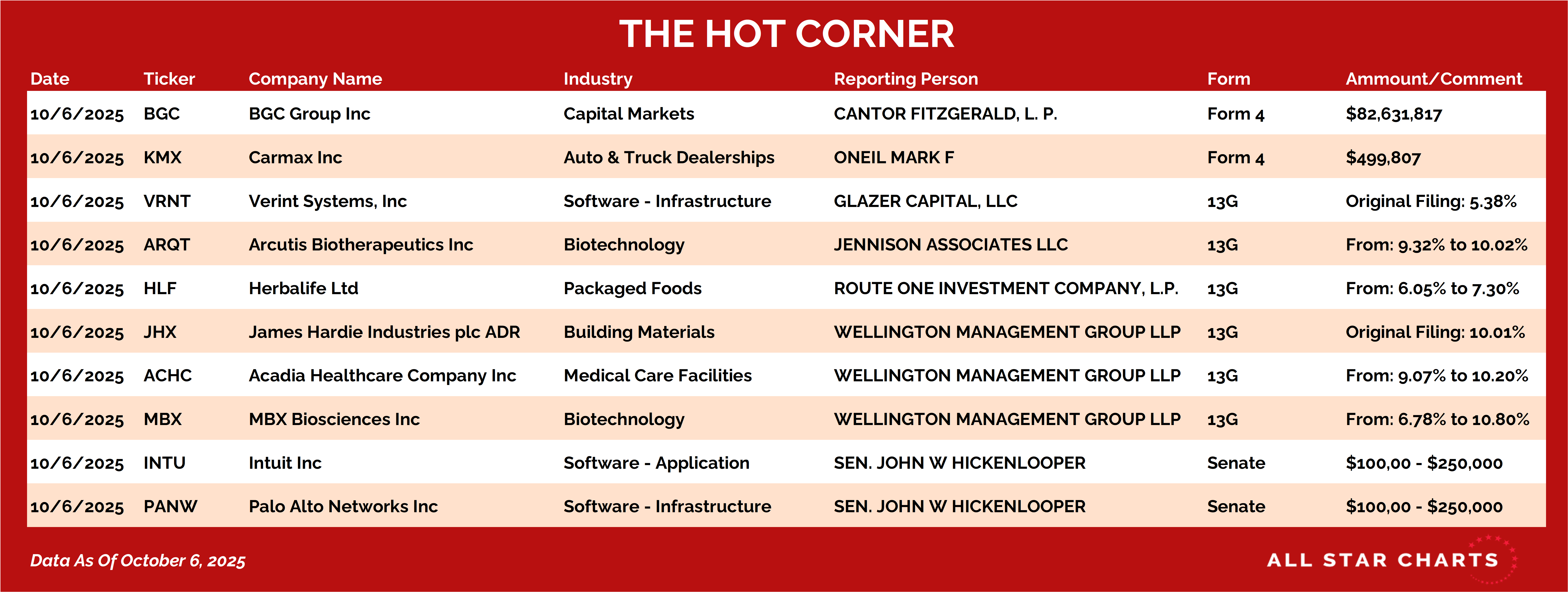

Cantor Fitzgerald Reports an $82.6 Million $BGC Buy

October 7, 2025

The recording and the chartbook for the October 6 Weekly Strategy Session are now available for Hot Corner Insiders.

Stay tuned. We'll be back Wednesday with more insider activity.