🔎 Pacific Markets at a Key Level

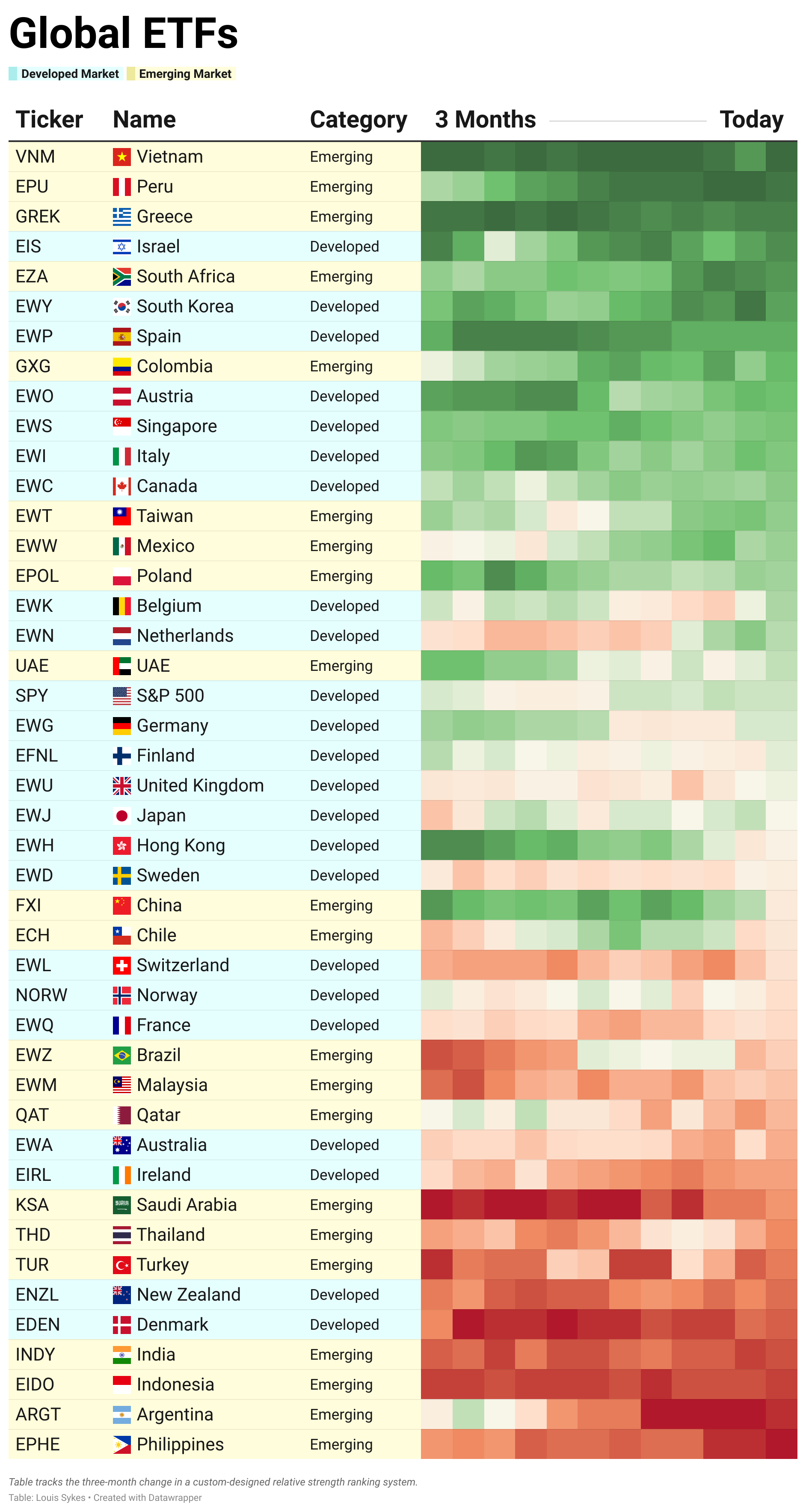

📊 Daily ETF Overview

This year has been a standout for global markets, delivering strong returns for investors. Over the past decade, the United States has led the way in performance — but 2025 has told a different story.

That’s why keeping a close eye on the international landscape, and the strength coming from these markets in particular, is more important than ever.

Markets ended last week with a distinctly risk-off tone.

While a single day doesn’t define a trend, it did mark a sharp shift from the unusually calm environment investors had grown accustomed to.

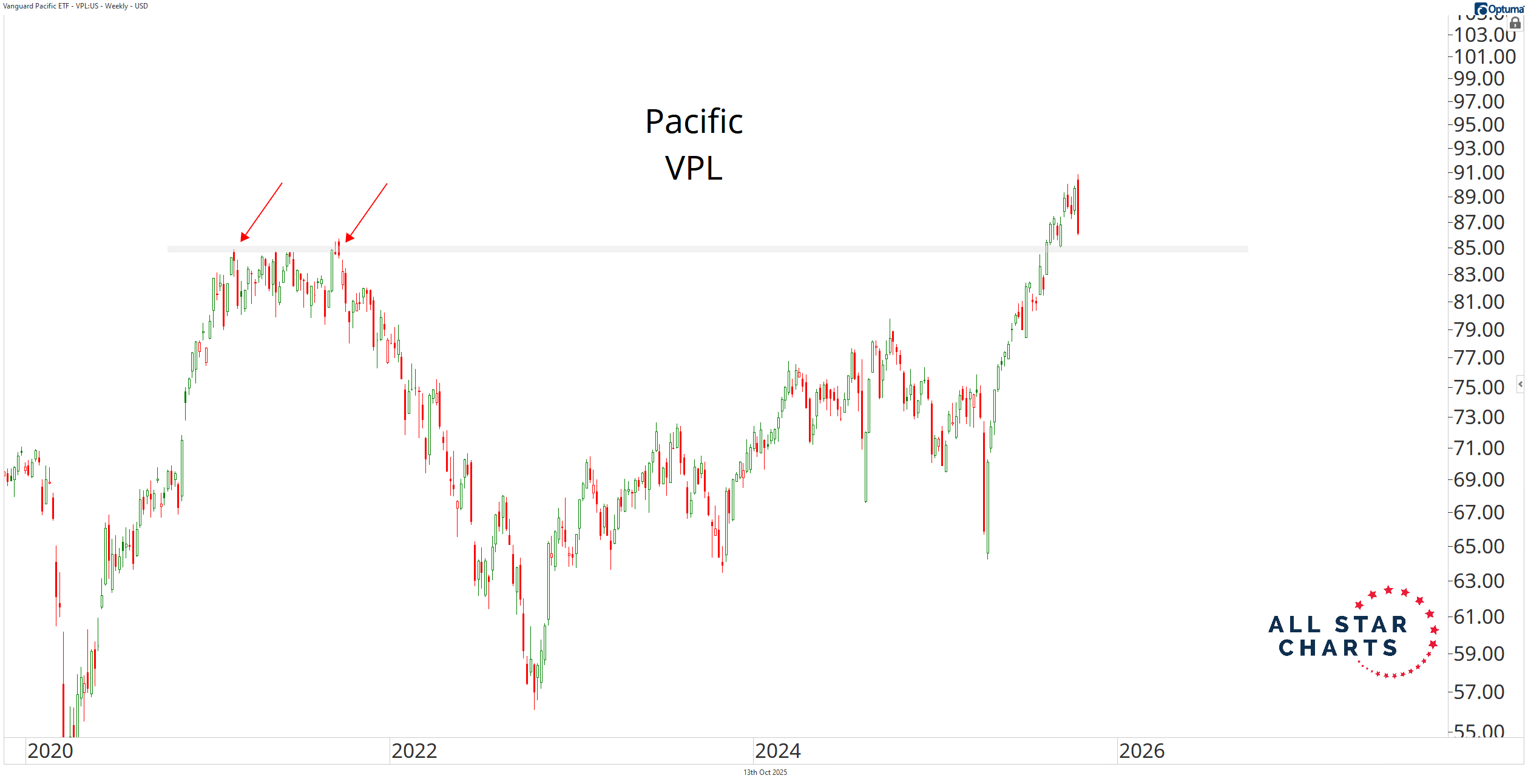

One region worth highlighting is the Pacific — tracked by $VPL — which is currently trading at a key support level. This ETF holds stocks primarily from Japan, along with South Korea, Australia, Singapore, Hong Kong, and New Zealand.

If VPL were to break below this level, it would signal that a large and influential region on the global stage is starting to show vulnerability.

With many key indices and ratios also pressing up against similarly important levels — which we’ll be highlighting throughout the week — we have a clear set of boundaries to gauge whether the tide is turning for global risk.