Top Down Trade of the Week (02/14/2026)

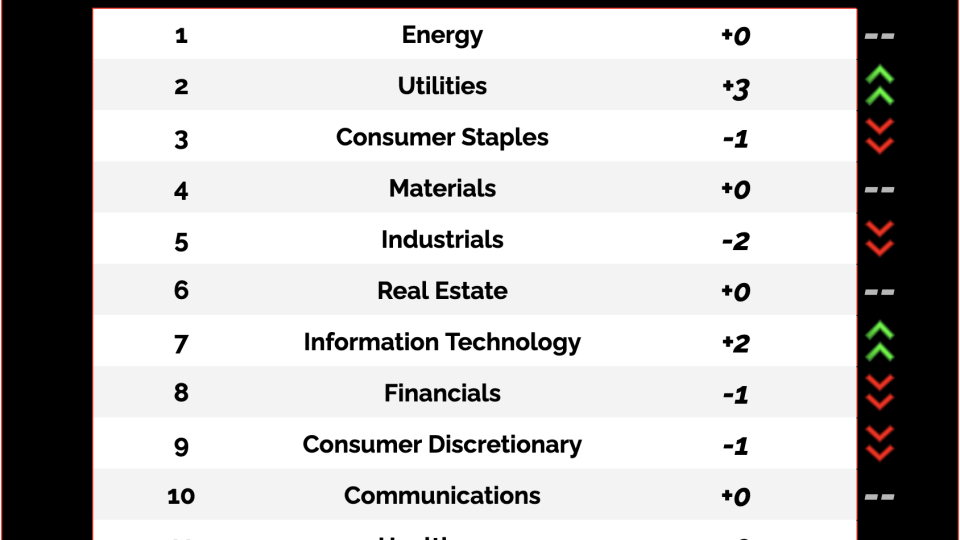

Buying the new leadership in Utilities

February 14, 2026

Members Only

Displaying 14905 - 14928 of 20772

Recent Episodes

Missed it? No problem!

Replays of all our past episodes are always available in the episode archives.