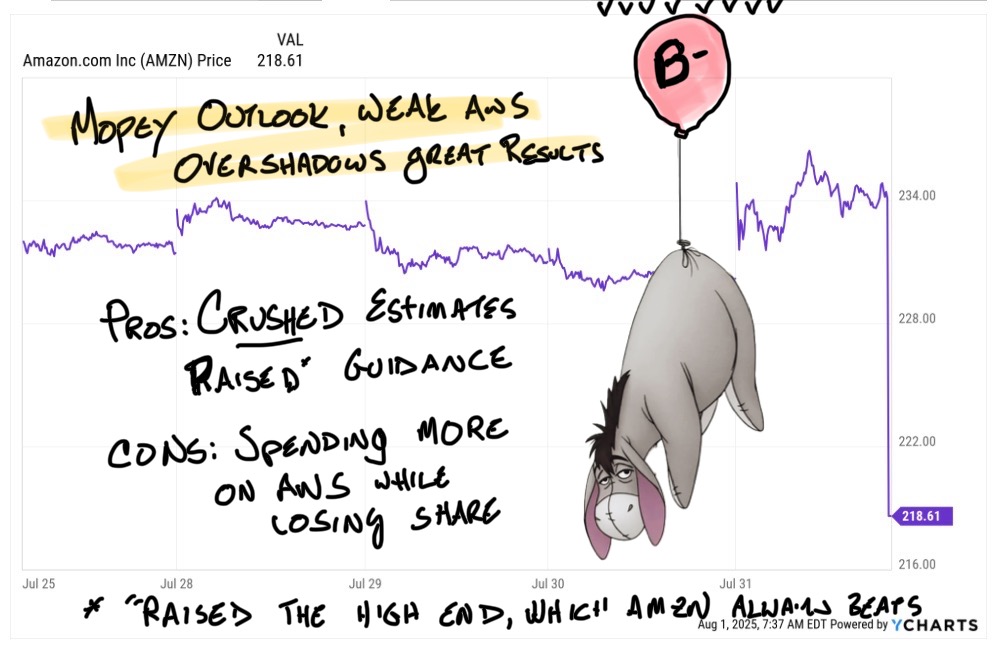

Amazon Earnings Report Card

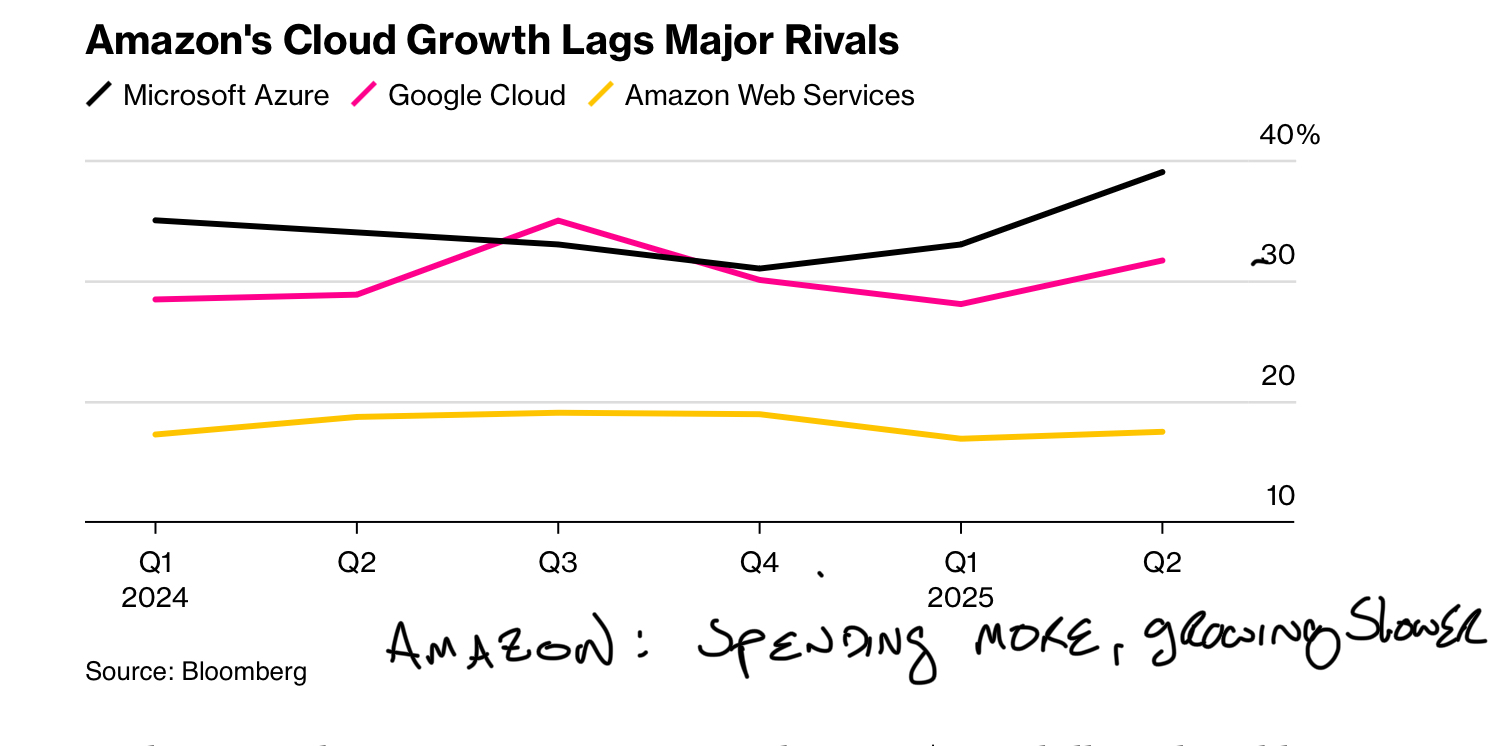

AWS growth: C-

Amazon's AWS is the biggest dog in the cloud fight, so far, but the lead is shrinking. As Jassey noted, AWS grew 17.5% and is on a $123 billion annualized run rate. In the first six months of the year AWS had net sales of $60 billion with profits of $21.7 billion. The company has more demand than capacity (the main constraints being chips and power).

Jassey is right when he says it's difficult to find any business opportunity, now or in history, that is as profitable with more potential than the AI / Cloud combination.

Two problems with that. First, Cisco used to say the same type of things about routers, which didn't end well. Second, the competition is gaining on Amazon and Jassey rather stubbornly refused to explicate the opportunity, but did lay out the $118 billion expected outlay.

Brian Novak of Morgan Stanley stuck the knife deep during the call. "There is a Wall Street person narrative that AWS is falling behind in generative AI. Could you address that? And is there any reason to think it shouldn't accelerate in the back half given the size of the opportunity?"

Suffice it to say, refusing to break out revenue projections, or even goals, for the second half of the year did little to change the narrative. Right around the time of this answer, Amazon's stock started moving decisively lower after-hours. It was clear the flat-out remarkable performance of literally everything else at Amazon last quarter was going to be ignored.

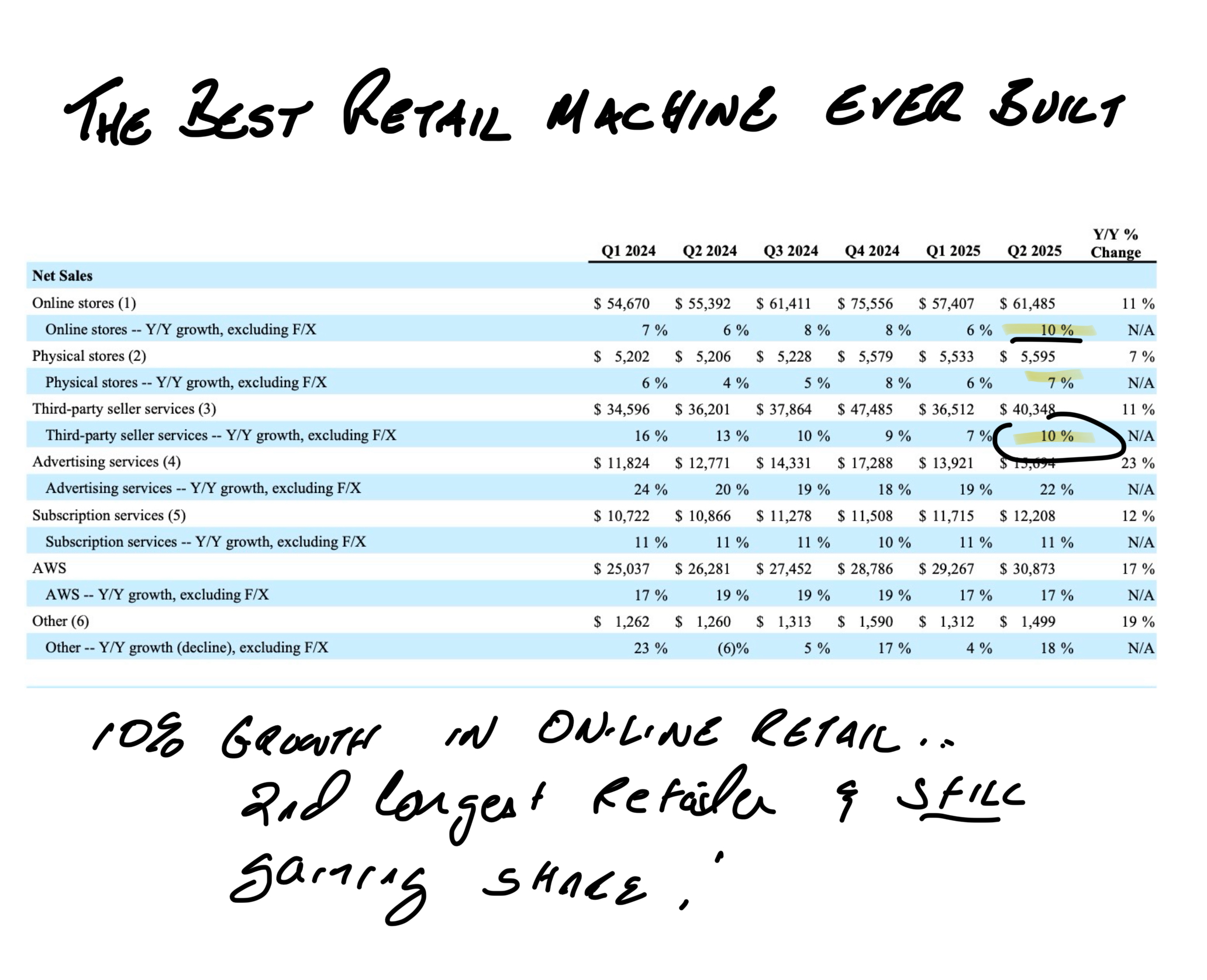

Retail: A+

Amazon's retail business is an unstoppable juggernaut. Third Party and Amazon's online business both grew 10%, much better than expectations. Amazon hasn't seen any pullback by consumers or an increase in prices due to tariffs.

End of story. I might have been the most excited person when it came to this stunning performance, but I think it matters. Everything Amazon does well flows from retail and Amazon's unparalleled touch with consumers. Before the AI explosion, Amazon used to talk a lot about getting to the point of first next day, and now same day delivery. It seemed impossible to the point of lunacy that a company without stores would be able to execute with that type of speed and efficiency.

If you live in a major metropolitan area same day delivery is almost expected.

If you're a retail wonk, you can hang this quarter in the Louvre. Walmart won't come close to these numbers when it reports in three weeks. Target can't even dream of 10% growth in its main categories or, for that matter, 7% growth in Amazon's physical stores, which have become an afterthought in Amazon's growth plans.

"Subscription Services" (read: Prime) grew 11%. This was before Prime Day. Do you know anyone who doesn't have Prime but is still considering it? I don't. Yet there it is, 6 straight quarters of 10% or more growth in signing up insanely high-profit Prime members. It's the greatest loyalty program since the invention of Sky Miles and gets almost no attention.

This is the best retailer in the world, and it's not even close. Alas, Amazon's narrative is now that it's an underperforming player in Cloud. Seems a little unfair but the bar gets raised when people get used to such stellar execution.

Final Grade: B-

Messaging matters. This was a great quarter everywhere except the one area everyone wants to discuss. It's right for shares to take a hit today but I doubt it keeps them down for very long.

How I'm trading Amazon

None of which is going to save shares of Amazon today. Amazon didn't say what the Street wanted to hear and is getting punished accordingly. Past resistance is now support at $200. If the company should get there again, I'll consider it a gift. Amazon has the money to invest whatever it needs to capture more than its share and still has the smartest team in retail, if not all of corporate America.

Barring a total collapse in consumer spending, Amazon will continue to post huge numbers in the 3rd and 4th quarters. With a collapse in consumer spending, Amazon will take enormous amounts of share. I trust the company to invest wisely.

This is a stock to own for the long term. Let the dust settle and look to buy.