The Crowd Is Looking the Wrong Way

New competitors are eating Ethereum and Solana's lunch.

February 14, 2026

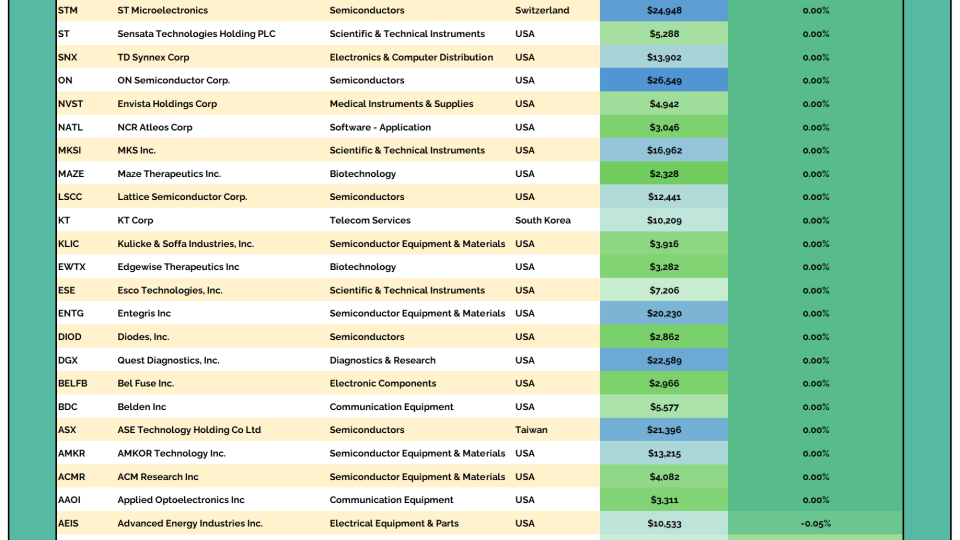

Displaying 25 - 48 of 20771

Recent Episodes

Missed it? No problem!

Replays of all our past episodes are always available in the episode archives.