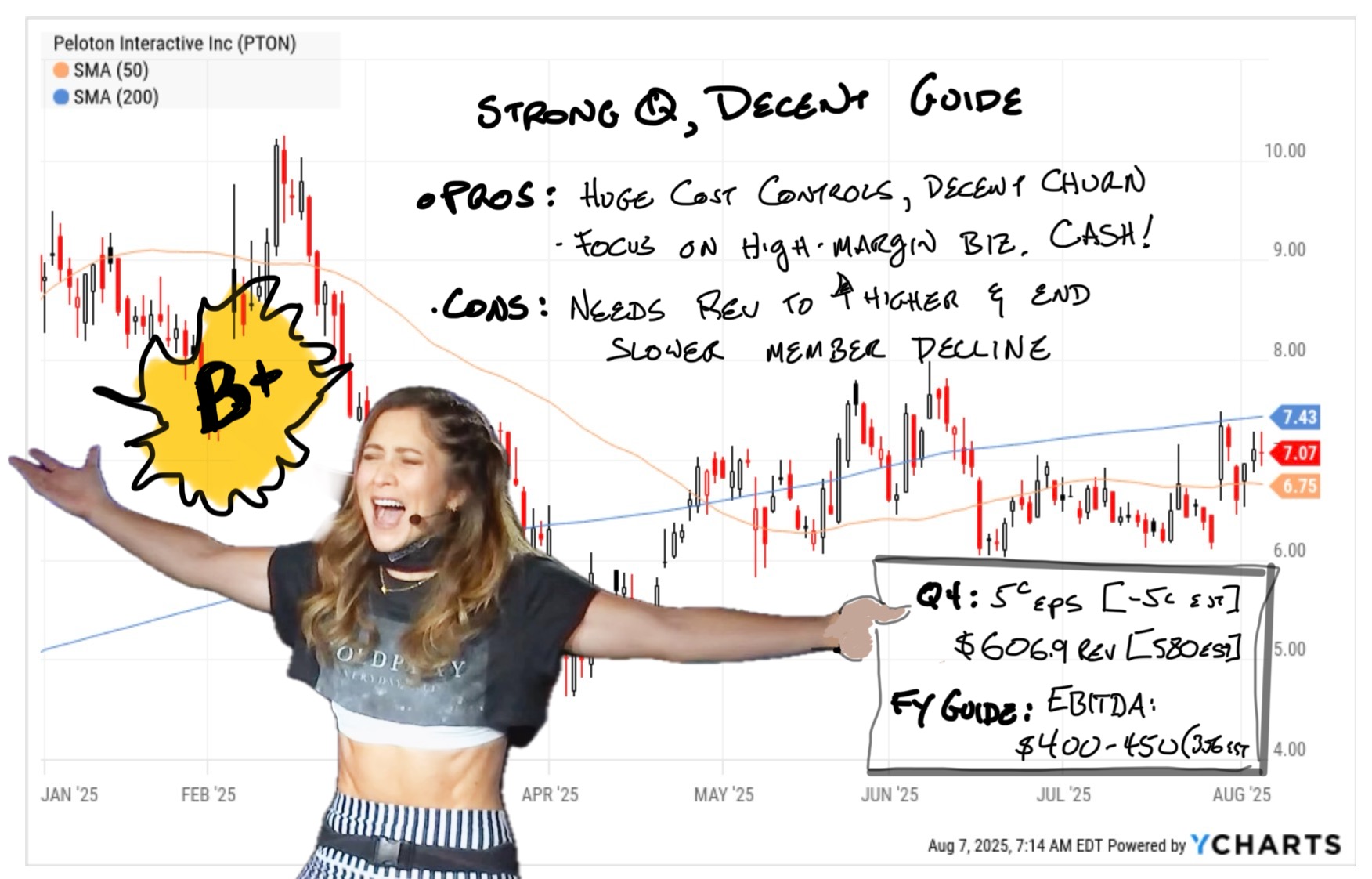

Peloton Report Card

Management Setting, and Reaching Coherent, Ambitious Goals: A

Years ago Peloton's goal amounted to "everyone in the world riding and subscribing to Peloton".

That was an insane plan. The stock was going to be a long-term COVID bubble victim, no matter what management did, but the way Peloton management spent money and expanded in a haphazard way almost killed the company entirely.

When Barry McCarthy left the BOD stepped in an created a new plan. The emphasis would switch from a growth to a maintenance model. Gone was ~$100 million / quarter in "R&D". Stores were closed. Expenses were rationalized.

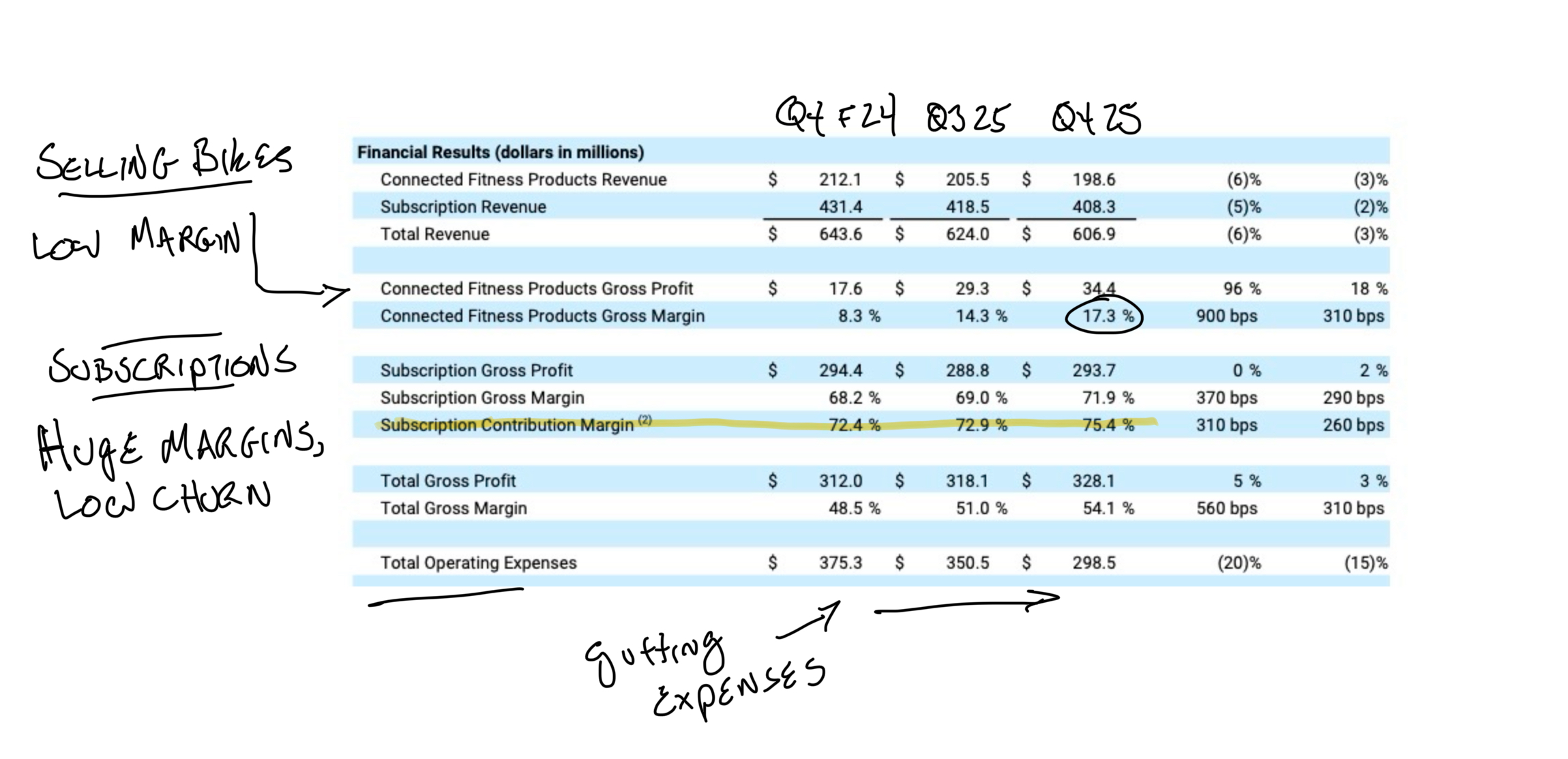

Exercise equipment is a slow-growth, low-margin business. Streaming content to paying members who use your product every day and are happy to pay $2 a day to do so is an amazing, high-margin business. Peloton did the obvious, smart thing and focused on the latter. The results show up in the financials:

Adjusted EBITDA went from $4 million two years ago to $400 million last year and restructured $1.4b in debt. They ended the quarter with $1.4B in cash and have outstanding debt they could restructure at a penalty, but is choosing not to out of prudence.

This isn't a dying company.

Still Not Growing (but executing a plan): C-

The quibble with Peloton as a stock is revenue grinding lower, albeit at a slower rate. Peloton subscribers are loyal (slightly obsessive) about the product. If you stop selling bikes you become reliant on the customers you have not choosing to dump the service. So far, churn has stayed low, even as Peloton has been reducing costs. That's great and the main reason why Peloton is now a cash-generating company instead of a doomed fad business.

Though more cash-saving options are coming ($100 million this year), Peloton is just getting started on ways to resume growth.

Some of these are initiatives you can see if you spend much time in mid to higher-end hotels, where Peloton bikes are becoming ubiquitous in gyms. Others are still in development, such as Peloton's new plan to serve as a "Healthstyle" company, helping users monitor all aspects of their exercise lives.

Peloton is a lousy short here already, just based on the cash-flow improvements and Peloton not turning in a flat-out disaster of a quarter for over a year. For Peloton shares to go next level (read: to get from $10 to $20) the company will need to start growing again at some point. Look for traction in this area over the next couple of quarters.

Total Grade: B+

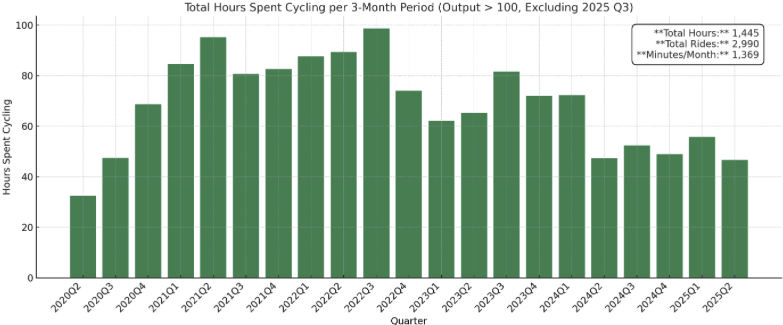

Make no mistake, by Peloton standards the quarter was an A and the call was close to an A+ compared to years past. Peloton isn't delivering Amazon-type of numbers quarter after quarter. According to workout data I stuffed through ChatGPT, I've used my bike an average of 45 minutes every day since 2020. Not for the classes or the cult (usually I'll watch CNBC or Netflix while I ride), but because the bike is reliable and I have a para-social relationship with online workout "partners" I'll likely never meet in person.

I belong to a very gym but Peloton is where I work out. About 3 million people are doing the same thing. That's a viable business. I was long PTON for years and didn't go back in until last fall. For the RoundUp portfolio, our cost basis is below $7 and the shares are now sporting a decent gain. I suspect it keeps working.

Plan

Never buy a company like this up 15% on the day. If Peloton drifts back towards $7 over the next few weeks or beyond I'd add to the position aggressively. The short thesis ("Peloton goes bankrupt") is garbage unless or until Peloton faceplants dramatically in the next few quarters. I don't expect that to happen.