Amazon: Betting On What Doesn’t Change

Books were not the vision, they were the starting point.

December 13, 2025

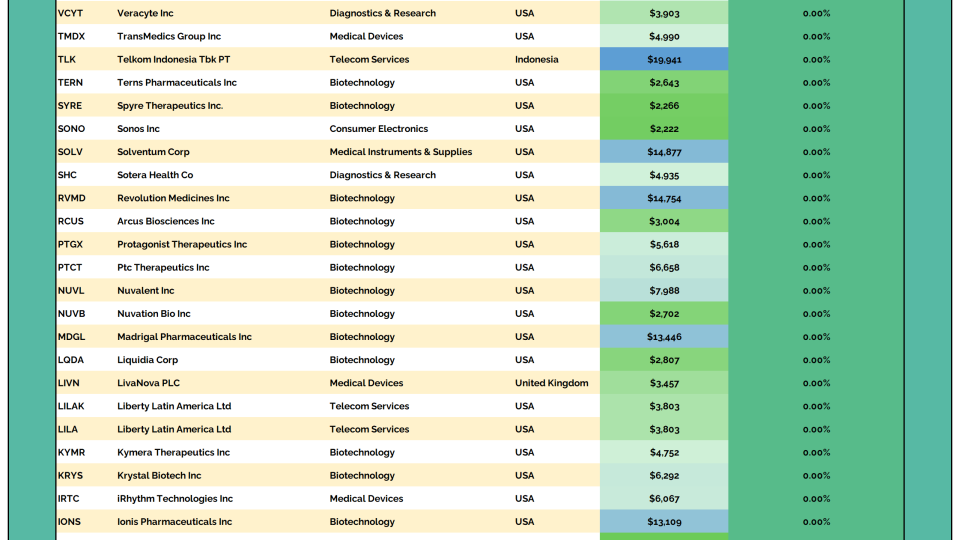

Displaying 169 - 192 of 20061

Recent Episodes

Missed it? No problem!

Replays of all our past episodes are always available in the episode archives.